Direct Tax Vivad Se Vishwas Scheme 2.0 for 2024

The Income Tax Department has announced 1st October 2024 as the date from which the Direct Tax Vivad Se Vishwas Scheme 2024 will be applicable.

Taxes are the biggest source of money for the government, which uses this money to improve public services. A large part of the government's income comes from direct taxes, with income tax being the most significant component.

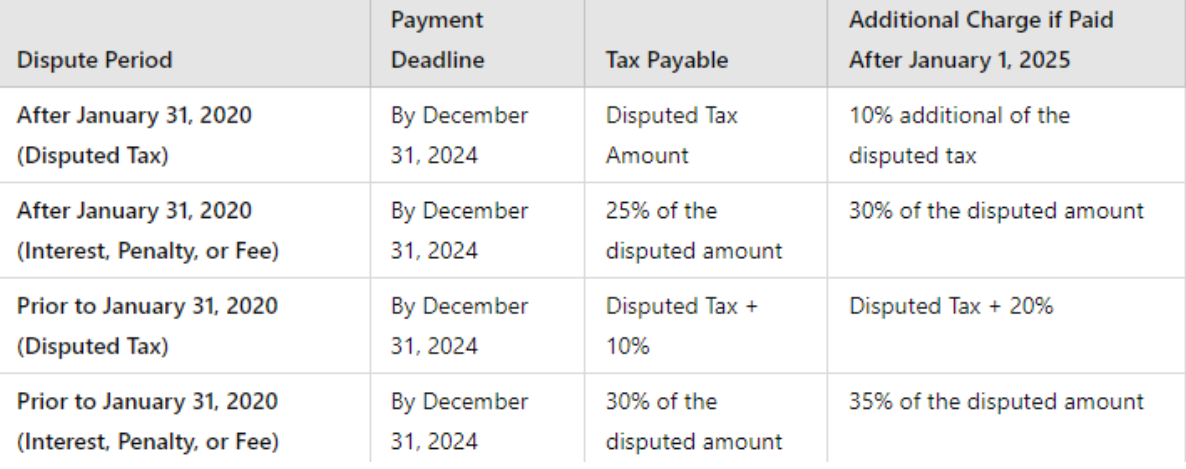

In the Finance Bill 2024, the government announced a new scheme called the Direct Tax Vivad Se Vishwas Scheme 2024. This scheme will allow taxpayers who have pending tax disputes to resolve them by paying a portion of the disputed tax amount. This decision was made because the earlier Direct Tax Vivad Se Vishwas Scheme 2020 was successful in collecting a significant amount of taxes. The taxes required to be paid under the scheme are mentioned in the following image

Business Support Services

Navigate your business challenges with confidence. Our comprehensive support services offer the expertise you need to thrive in today's competitive market.

Get SupportThe Income Tax Department formally announced October 1, 2024, as the starting date for this scheme through a notification dated September 19, 2024 (Notification No. 103/2024-Income Tax). The government also released a separate notification on September 20, 2024 (Notification No. 104/2024) outlining the Direct Tax Vivad se Vishwas Rules, 2024, and the necessary forms.

The main goal of this scheme is to reduce the backlog of income tax disputes. Those disputes which are pending against the following forums can be resolved in this scheme:

- The Supreme Court, High Court, Income Tax Appellate Tribunal, Commissioner/Joint Commissioner (Appeals)

- The Dispute Resolution Panel (DRP) or where DRP directions have been issued but the final assessment order is awaited

- Revision petitions pending before the Commissioner of Income Tax.

This scheme is another step taken by the government to simplify tax administration and encourage tax compliance. The Direct Tax Vivad Se Vishwas Scheme 2.0 offers immunity from penalties and interest for matters opted under the scheme for tax arrears.

Additionally, a declaration made under this scheme won't set a precedent for either the taxpayer or the tax authority regarding the issues covered in the declaration. This scheme will not apply in certain cases like searches and seizures, prosecutions, undisclosed income/assets located overseas, and proceedings under other specified laws.

Stay Updated

Subscribe to our newsletter and never miss an update.